Jan 25, 2020 | Market Commentary

The coronavirus outbreak in China shook markets mid-January. Markets entered 2020 on an optimistic note following the Phase 1 trade…

December Monthly Market Commentary

Jan 24, 2020 | Market Commentary

Trade news primarily drove market sentiment as 2019 came to a close. Progress towards a “Phase 1” trade agreement with China continued with both countries signing the accord in January. At its December meeting, the Fed reiterated its stance that monetary policy was...

November Monthly Market Commentary

Dec 11, 2019 | Market Commentary

The U.S. and China continued to make progress towards a “Phase 1” trade agreement. Most developed economy central banks, including the Federal Reserve (Fed), were on the sidelines in November. Risks assets performed well in November with equity markets touching new...

Goldilocks

Jul 1, 2019 | Market Commentary

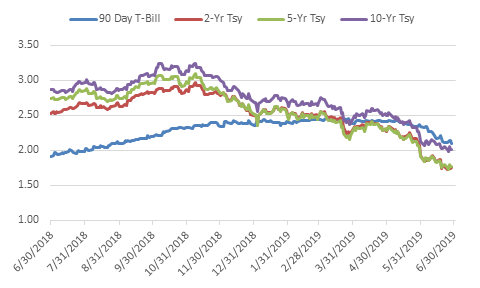

The 10-year Treasury yield peaked at 2.60% early in the quarter before plunging to 2.01% at the end of June.

That's All Folks

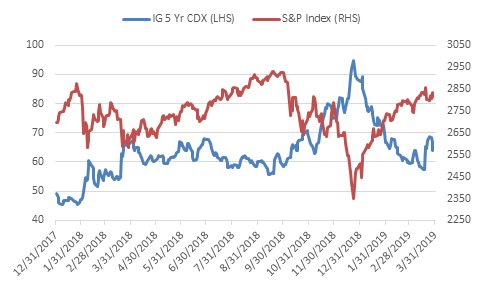

Apr 1, 2019 | Market Commentary

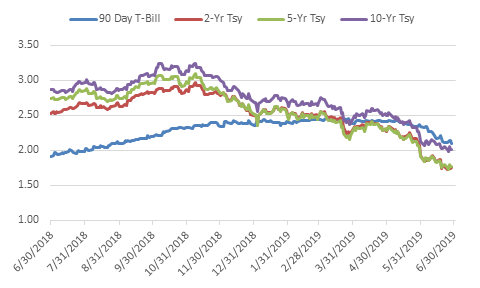

Domestically, the Federal Reserve’s 180-degree policy pivot, a pause in rate hikes and possible adjustments to balance sheet rundown prior to the end of 2019, was cemented at the March meeting driving yields lower across the curve.

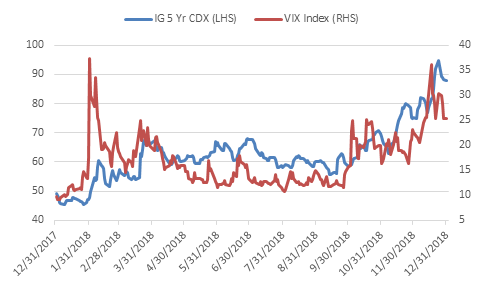

Volpocalypse Redux

Jan 1, 2019 | Market Commentary

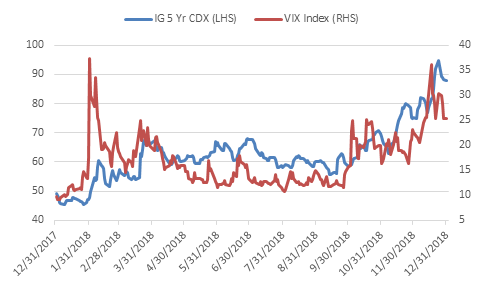

This reaction coupled with data indicating slowing global growth, impending Brexit politics, trade wars, and domestic government strife amplified risk aversion already exacerbated by thinly staffed trading desks around the holidays.