Our Insights

See what we have accomplished

Our Research Collection

Sort Collection By Year:

Budget Resolutions Set Stage for Costly Reconciliation

March 5, 2025

The Senate and House each recently passed budget resolutions following a protracted debate in the House with fiscal hawks about cost savings. Although these resolutions don’t actually do anything to the budget today, they pave the way for the reconciliation bill(s) that could ultimately impact the deficit and Treasury issuance.

Read More

March 5, 2025

The Senate and House each recently passed budget resolutions following a protracted debate in the House with fiscal hawks about cost savings. Although these resolutions don’t actually do anything to the budget today, they pave the way for the reconciliation bill(s) that could ultimately impact the deficit and Treasury issuance.

Read More

Early Brinksmanship Shines Fresh Light on Debt Limit

January 11, 2023

House Republicans and Senate Democrats emerged from the November 2022 elections with very slim majorities, posing meaningful challenges over the next two years. The early intra-party tussle...

Read More

January 11, 2023

House Republicans and Senate Democrats emerged from the November 2022 elections with very slim majorities, posing meaningful challenges over the next two years. The early intra-party tussle...

Read More

4Q Market Commentary 2021

February 3, 2022

Risk assets recovered from Omicron fears and Fed pivot away from accommodative policy to close the year near record high price levels. The Federal Reserve continues along its path away from...

Read More

February 3, 2022

Risk assets recovered from Omicron fears and Fed pivot away from accommodative policy to close the year near record high price levels. The Federal Reserve continues along its path away from...

Read More

Unprecedented Front-End Repricing Creates Opportunities

February 2, 2022

The Fed has clearly pivoted hawkish coming into 2022. Fed fund futures are now pricing in nearly five rate hikes compared to just one hike priced in at the end of 3Q21.

Read More

February 2, 2022

The Fed has clearly pivoted hawkish coming into 2022. Fed fund futures are now pricing in nearly five rate hikes compared to just one hike priced in at the end of 3Q21.

Read More

2Q21 Market Commentary

August 5, 2021

Risk assets pushed to new highs as economic growth accelerated and earnings expectations rose. Most pandemic restrictions have been lifted leading to a broad, fast-paced reopening straining portions of the economy.

Read More

August 5, 2021

Risk assets pushed to new highs as economic growth accelerated and earnings expectations rose. Most pandemic restrictions have been lifted leading to a broad, fast-paced reopening straining portions of the economy.

Read More

Tightening Taken with a Big Grain of Salt

June 22, 2021

The dot plot for the June FOMC meeting was unexpectedly hawkish as Fed officials, at the median, forecasted two rate hikes by the end of 2023. This was in contrast to the prior March reading that anticipated...

Read More

June 22, 2021

The dot plot for the June FOMC meeting was unexpectedly hawkish as Fed officials, at the median, forecasted two rate hikes by the end of 2023. This was in contrast to the prior March reading that anticipated...

Read More

1Q21 Market Commentary

March 21, 2021

The January Georgia runoff election gave the Democratic Party a one-vote advantage in the Senate and the Biden Administration wasted no time pushing through a new round of massive fiscal spending.

Read More

March 21, 2021

The January Georgia runoff election gave the Democratic Party a one-vote advantage in the Senate and the Biden Administration wasted no time pushing through a new round of massive fiscal spending.

Read More

4Q Market Commentary

January 26, 2021

Risk assets rallied to new highs as 2020 came to a close. Expectations of further fiscal stimulus and optimism that vaccines will curb the economic impact of the pandemic buoyed market sentiment.

Read More

January 26, 2021

Risk assets rallied to new highs as 2020 came to a close. Expectations of further fiscal stimulus and optimism that vaccines will curb the economic impact of the pandemic buoyed market sentiment.

Read More

Looking Beyond the Current Surge in Infections

November 18, 2020

1-5 year corporate credit is on track to achieve a consecutive year of strong total return. Based on the Bloomberg Barclays Investment Grade 1-5 Year U.S. Corporate Bond Index as of October 31, 2020...

Read More

November 18, 2020

1-5 year corporate credit is on track to achieve a consecutive year of strong total return. Based on the Bloomberg Barclays Investment Grade 1-5 Year U.S. Corporate Bond Index as of October 31, 2020...

Read More

3Q Market Commentary

October 29, 2020

Fixed income markets largely treaded water over the quarter as states reopened and isolated surges were watched with trepidation while equity markets pushed ever higher as economic data demonstrated the resilience of the domestic economy.

Read More

October 29, 2020

Fixed income markets largely treaded water over the quarter as states reopened and isolated surges were watched with trepidation while equity markets pushed ever higher as economic data demonstrated the resilience of the domestic economy.

Read More

Incorporating ESG Factors into Our Investment Framework

September 1, 2020

A central tenant in fixed income investing is risk minimization; therefore, an analysis of ESG issues is paramount to fully embracing the practice of prudence

Read More

September 1, 2020

A central tenant in fixed income investing is risk minimization; therefore, an analysis of ESG issues is paramount to fully embracing the practice of prudence

Read More

2Q20 Market Commentary

July 21, 2020

Markets continued to rally over the quarter as expansive monetary policy and fiscal stimulus offset the economic distress brought on by coronavirus

Read More

July 21, 2020

Markets continued to rally over the quarter as expansive monetary policy and fiscal stimulus offset the economic distress brought on by coronavirus

Read More

ZIRP Returns! – Extend Duration in Short Corporate Bond Portfolios

June 12, 2020

Following the June FOMC meeting, the Fed released its first summary of economic projections (“SEP”) incorporating impacts from the Covid-19 pandemic.

Read More

June 12, 2020

Following the June FOMC meeting, the Fed released its first summary of economic projections (“SEP”) incorporating impacts from the Covid-19 pandemic.

Read More

Don’t Fight the Fed

April 27, 2020

Price action in investment grade corporate credit during the month of March was historic.

Read More

April 27, 2020

Price action in investment grade corporate credit during the month of March was historic.

Read More

Negative Real Yields and Buoyant Equities Send Mixed Signals

February 20, 2020

Relative to Covid-19, a possible Middle East conflict with Iran at the beginning of the year was met with little...

Read More

February 20, 2020

Relative to Covid-19, a possible Middle East conflict with Iran at the beginning of the year was met with little...

Read More

January Monthly Market Commentary

January 25, 2020

The coronavirus outbreak in China shook markets mid-January. Markets entered 2020 on an optimistic note following the Phase 1 trade...

Read More

January 25, 2020

The coronavirus outbreak in China shook markets mid-January. Markets entered 2020 on an optimistic note following the Phase 1 trade...

Read More

December Monthly Market Commentary

January 24, 2020

Trade news primarily drove market sentiment as 2019 came to a close. Progress towards a “Phase 1” trade agreement with...

Read More

January 24, 2020

Trade news primarily drove market sentiment as 2019 came to a close. Progress towards a “Phase 1” trade agreement with...

Read More

Diversifying Exposure Away From Corporate Credit on Relative Value

January 16, 2020

The aggregate U.S. corporate index had a historic year in 2019 achieving 14.3% in total return which was only bested...

Read More

January 16, 2020

The aggregate U.S. corporate index had a historic year in 2019 achieving 14.3% in total return which was only bested...

Read More

Underweight Food and Beverage Credit

December 19, 2019

This comes after a year of extremely negative returns of -4.45% compared to -2.81% for index eligible industrials with spread...

Read More

December 19, 2019

This comes after a year of extremely negative returns of -4.45% compared to -2.81% for index eligible industrials with spread...

Read More

November Monthly Market Commentary

December 11, 2019

The U.S. and China continued to make progress towards a “Phase 1” trade agreement. Most developed economy central banks, including...

Read More

December 11, 2019

The U.S. and China continued to make progress towards a “Phase 1” trade agreement. Most developed economy central banks, including...

Read More

Retail Sales

November 20, 2019

While prospective data for manufacturing activity appear to have bottomed out in August and September according to readings from purchasing...

Read More

November 20, 2019

While prospective data for manufacturing activity appear to have bottomed out in August and September according to readings from purchasing...

Read More

Repo Stress

September 20, 2019

The rate on overnight repo surged on Monday, 9/16 and remained elevated through the week causing the federal funds rate...

Read More

September 20, 2019

The rate on overnight repo surged on Monday, 9/16 and remained elevated through the week causing the federal funds rate...

Read More

Tame Inflation Affords Fed Room to Cut in September

August 15, 2019

Weakening sentiment as evidenced by global central banks’ dovish and the recent inversion in the 2s10s curve is likely to...

Read More

August 15, 2019

Weakening sentiment as evidenced by global central banks’ dovish and the recent inversion in the 2s10s curve is likely to...

Read More

Goldilocks

July 1, 2019

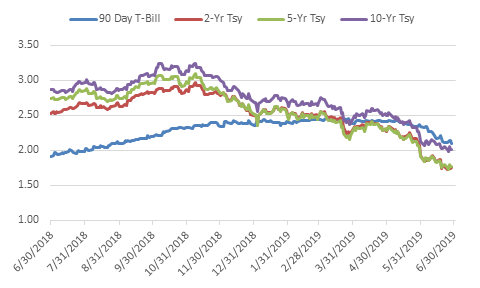

The 10-year Treasury yield peaked at 2.60% early in the quarter before plunging to 2.01% at the end of June.

Read More

July 1, 2019

The 10-year Treasury yield peaked at 2.60% early in the quarter before plunging to 2.01% at the end of June.

Read More

A Transition from LIBOR

June 26, 2019

Due largely to recent LIBOR manipulation scandals, regulators in the US are set to phase LIBOR out by the end...

Read More

June 26, 2019

Due largely to recent LIBOR manipulation scandals, regulators in the US are set to phase LIBOR out by the end...

Read More

Consumer ABS

June 13, 2019

Unlike senior unsecured corporate bonds, ABS transactions are structured so senior tranches are able to maintain AAA ratings even if...

Read More

June 13, 2019

Unlike senior unsecured corporate bonds, ABS transactions are structured so senior tranches are able to maintain AAA ratings even if...

Read More

Credit Cycle Rolls On

May 15, 2019

The Fed’s positioning still leaves room for a pivot back to hawkish, but the window may have already closed for...

Read More

May 15, 2019

The Fed’s positioning still leaves room for a pivot back to hawkish, but the window may have already closed for...

Read More

That’s All Folks

April 1, 2019

Domestically, the Federal Reserve’s 180-degree policy pivot, a pause in rate hikes and possible adjustments to balance sheet rundown prior...

Read More

April 1, 2019

Domestically, the Federal Reserve’s 180-degree policy pivot, a pause in rate hikes and possible adjustments to balance sheet rundown prior...

Read More

Rosy Markets

February 14, 2019

Sentiment for risks assets has vastly improved as fear of a recession induced by monetary policy missteps eased considerably with...

Read More

February 14, 2019

Sentiment for risks assets has vastly improved as fear of a recession induced by monetary policy missteps eased considerably with...

Read More

All About the Expectations

January 18, 2019

More recently, statements from Fed officials and minutes from the December FOMC meeting have firmly anchored dovish expectations at least...

Read More

January 18, 2019

More recently, statements from Fed officials and minutes from the December FOMC meeting have firmly anchored dovish expectations at least...

Read More

Volpocalypse Redux

January 1, 2019

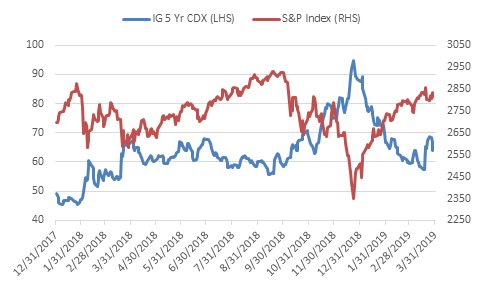

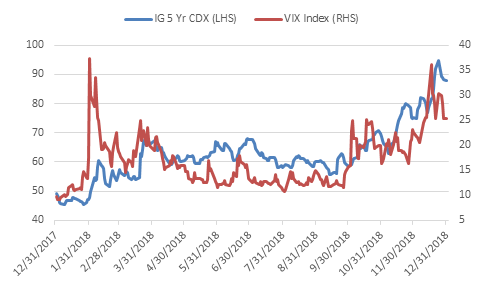

This reaction coupled with data indicating slowing global growth, impending Brexit politics, trade wars, and domestic government strife amplified risk...

Read More

January 1, 2019

This reaction coupled with data indicating slowing global growth, impending Brexit politics, trade wars, and domestic government strife amplified risk...

Read More

A Cautious Fed in the Year of the Pig

December 10, 2018

The persistent lingering of geopolitical issues that have seemingly reached maximum escalation only find new ways to further intensify driving...

Read More

December 10, 2018

The persistent lingering of geopolitical issues that have seemingly reached maximum escalation only find new ways to further intensify driving...

Read More

Rising Short Interest in High-Yield ETFs

November 11, 2018

Year-to-date, lower quality issuers have driven outperformance in the sector with excess returns of +2.6% for Single-B and +4.3% for...

Read More

November 11, 2018

Year-to-date, lower quality issuers have driven outperformance in the sector with excess returns of +2.6% for Single-B and +4.3% for...

Read More

Evolution of Firm Value Highlights ESG Issues

November 5, 2018

This increase not only includes technology firms whose values comprise the application of algorithms, but also firms that have paid...

Read More

November 5, 2018

This increase not only includes technology firms whose values comprise the application of algorithms, but also firms that have paid...

Read More

Onward and Upward

October 1, 2018

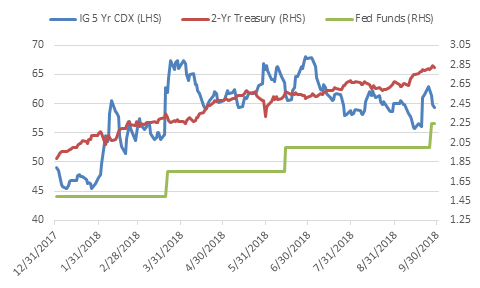

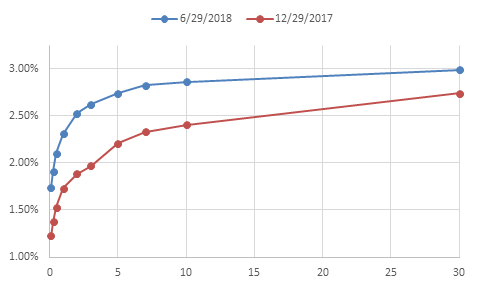

Over the quarter, the yield curve bear flattened as frontend yields rose 25-30 basis points while longer maturities rose 20-25...

Read More

October 1, 2018

Over the quarter, the yield curve bear flattened as frontend yields rose 25-30 basis points while longer maturities rose 20-25...

Read More

Monetary Mayhem and Geopolitics

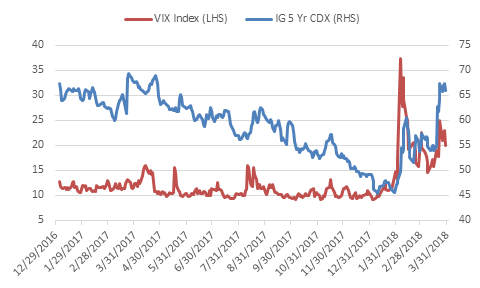

July 1, 2018

The European Central Bank (ECB) presented a fairly dovish outlook while the Federal Reserve (Fed) increased rates by 25 bps...

Read More

July 1, 2018

The European Central Bank (ECB) presented a fairly dovish outlook while the Federal Reserve (Fed) increased rates by 25 bps...

Read More

Trade Talk Tantrum

April 1, 2018

Economic activity lost some momentum from the fourth quarter, but remained healthy.

Read More

April 1, 2018

Economic activity lost some momentum from the fourth quarter, but remained healthy.

Read More

Off and Running

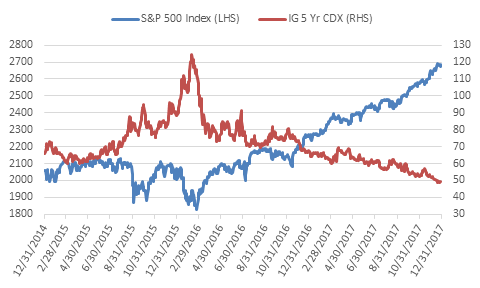

January 1, 2018

Further, Fed officials are forecasting three hikes in 2018 matching the 2017 pace.

Read More

January 1, 2018

Further, Fed officials are forecasting three hikes in 2018 matching the 2017 pace.

Read More

Conventional Policy for Unconventional Times

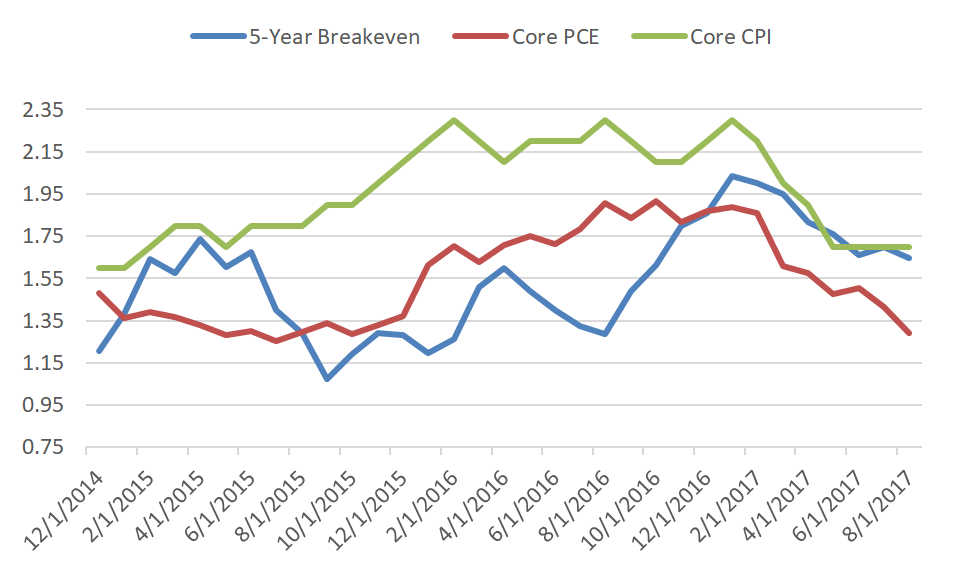

October 1, 2017

However, Fed officials opined that lower inflation was transitory and did not warrant deviations from policy forecasts jolting market expectations.

Read More

October 1, 2017

However, Fed officials opined that lower inflation was transitory and did not warrant deviations from policy forecasts jolting market expectations.

Read More

Prime Time

October 1, 2016

Investment grade credit traded in a fairly narrow band finishing the quarter almost unchanged.

Read More

October 1, 2016

Investment grade credit traded in a fairly narrow band finishing the quarter almost unchanged.

Read More

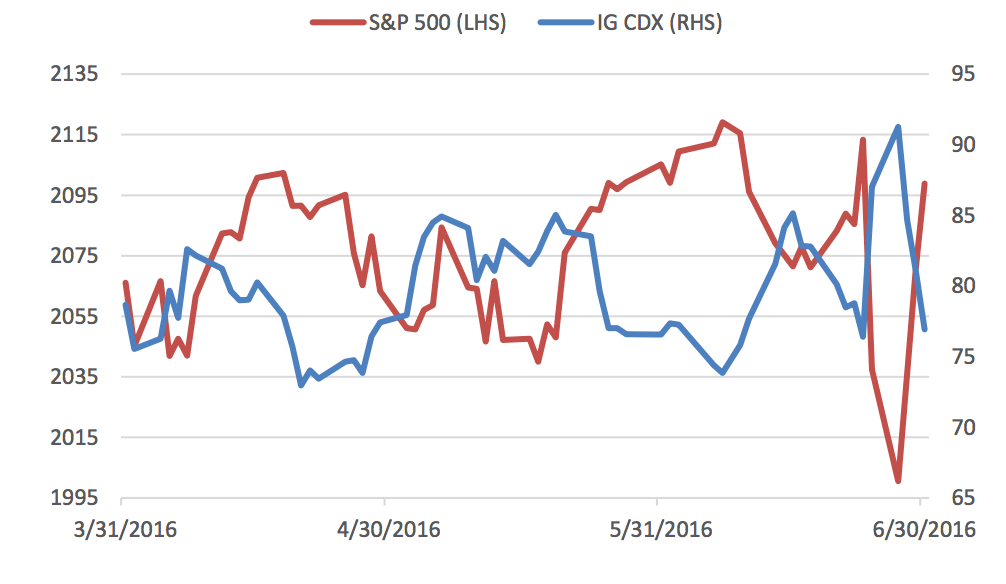

Much Ado about Nothing

July 1, 2016

The brief rout reversed on expectations of further easing by global central banks – a common elixir to economic malaise...

Read More

July 1, 2016

The brief rout reversed on expectations of further easing by global central banks – a common elixir to economic malaise...

Read More

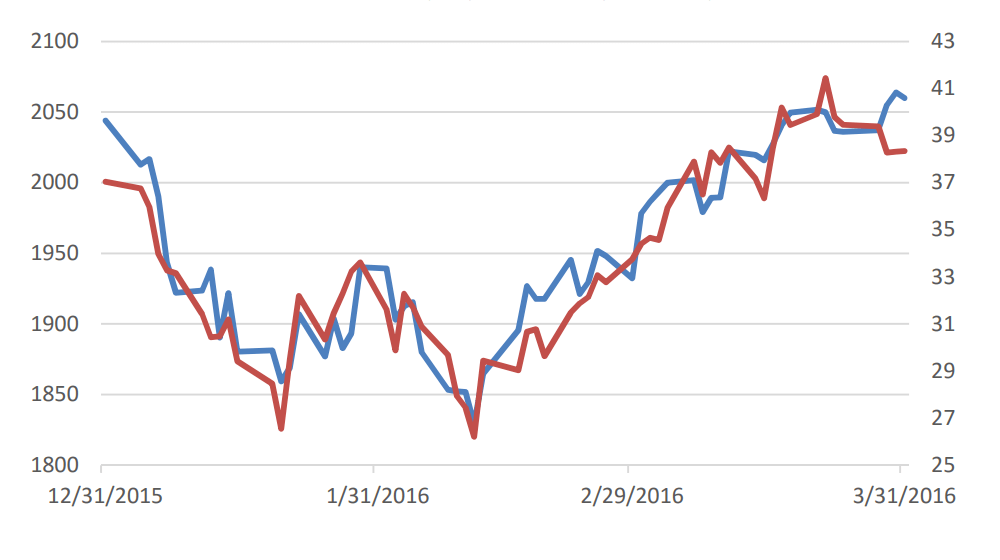

Employment, Price and Global Market Stability?

April 1, 2016

Credit spreads soared, especially for commodity related sectors.

Read More

April 1, 2016

Credit spreads soared, especially for commodity related sectors.

Read More

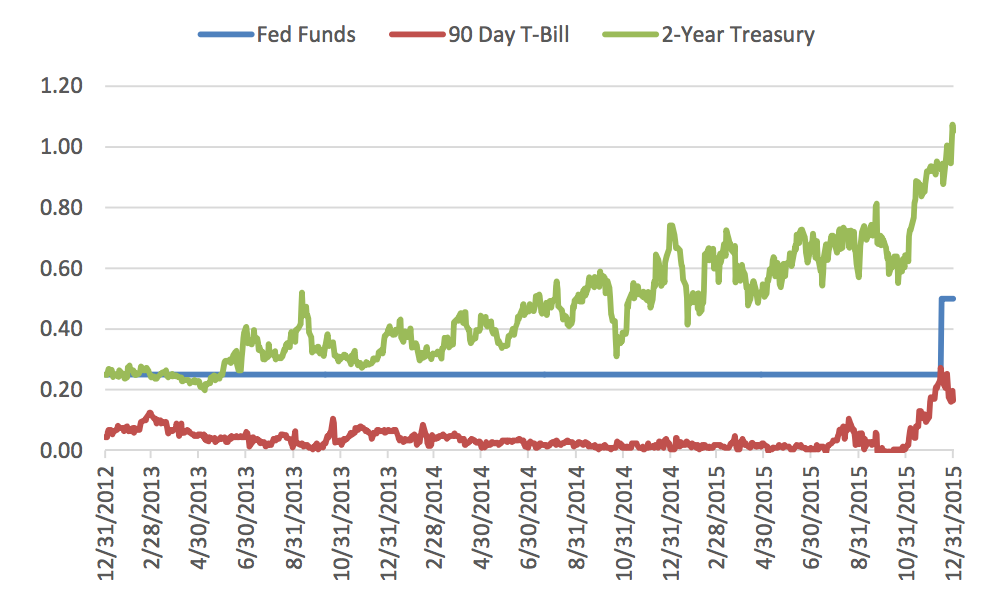

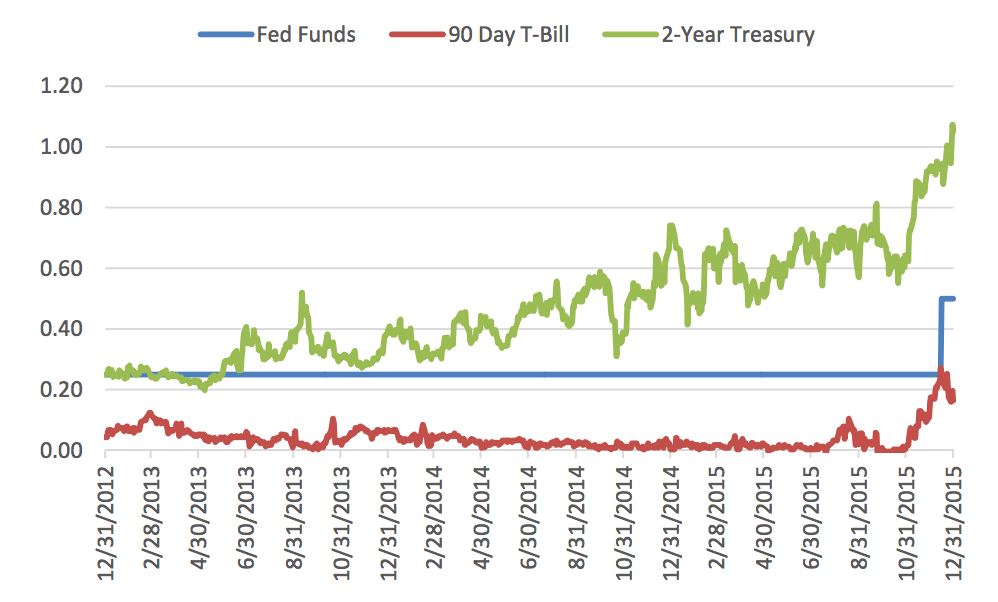

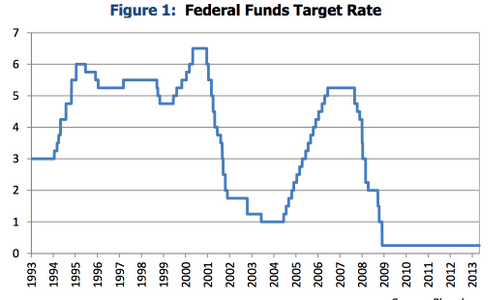

R.I.P. Z.I.R.P.

January 1, 2016

Commodity prices continued to come under pressure as well with oil declining 30% on the year.

Read More

January 1, 2016

Commodity prices continued to come under pressure as well with oil declining 30% on the year.

Read More

Lower for Longer

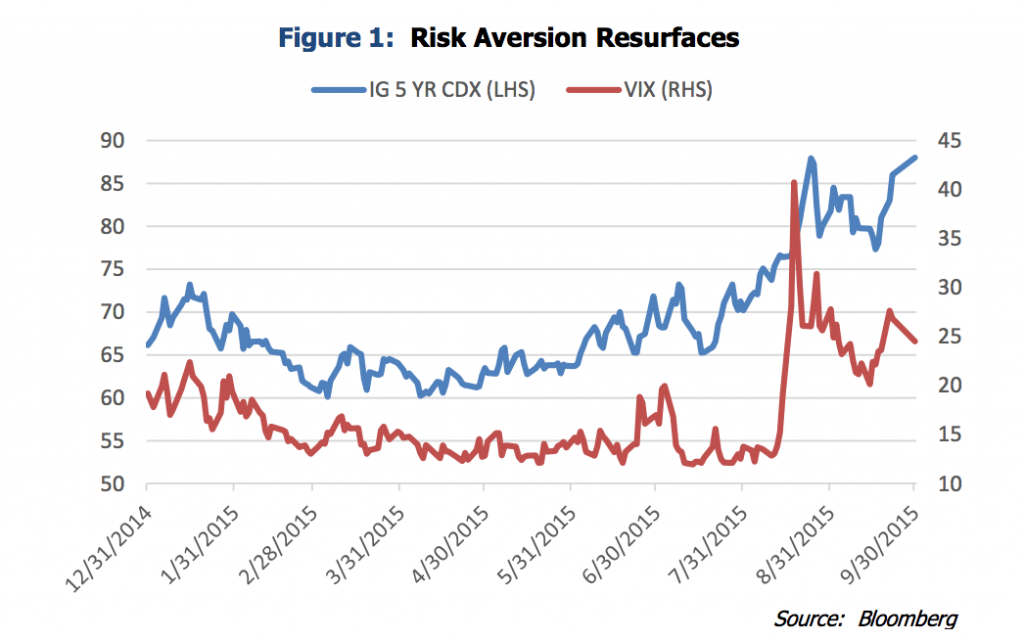

October 1, 2015

Energy and metals/mining sectors are stressed especially in the high yield space.

Read More

October 1, 2015

Energy and metals/mining sectors are stressed especially in the high yield space.

Read More

Are we there yet?

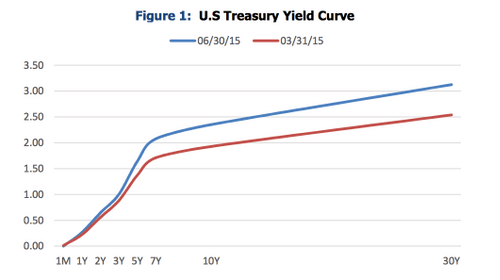

July 1, 2015

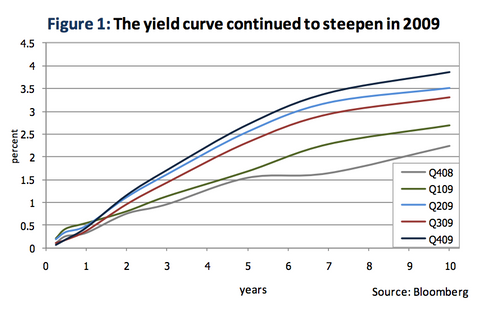

The yield curve bear steepened (see Figure 1) as two-year Treasury yields increased 9bps while the thirty-year Treasury yield increased...

Read More

July 1, 2015

The yield curve bear steepened (see Figure 1) as two-year Treasury yields increased 9bps while the thirty-year Treasury yield increased...

Read More

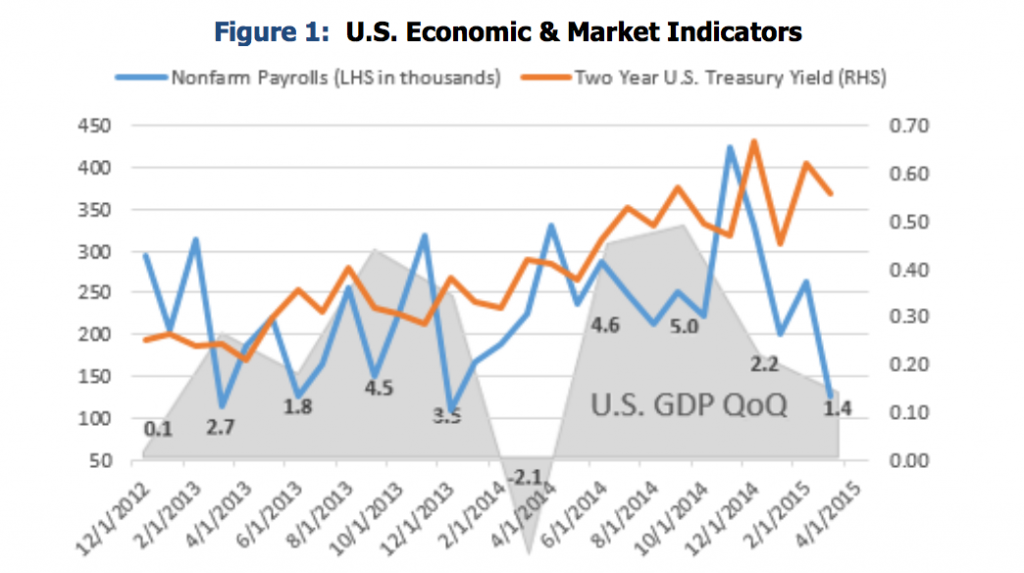

The Waiting Game

April 1, 2015

Risk assets delivered uneven results and U.S. Treasury yields were volatile as well (see Figure 1). On the quarter, performance...

Read More

April 1, 2015

Risk assets delivered uneven results and U.S. Treasury yields were volatile as well (see Figure 1). On the quarter, performance...

Read More

Lost in Translation

January 1, 2015

The New Year is an opportune time to ensure your policy and investment choices are equipped to take advantage of...

Read More

January 1, 2015

The New Year is an opportune time to ensure your policy and investment choices are equipped to take advantage of...

Read More

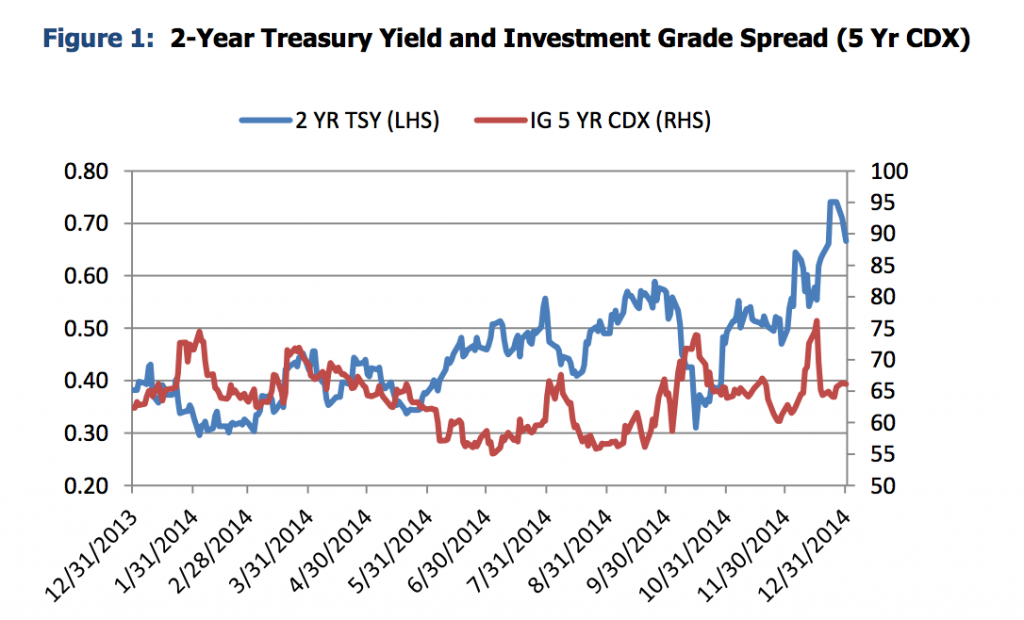

The Home Stretch

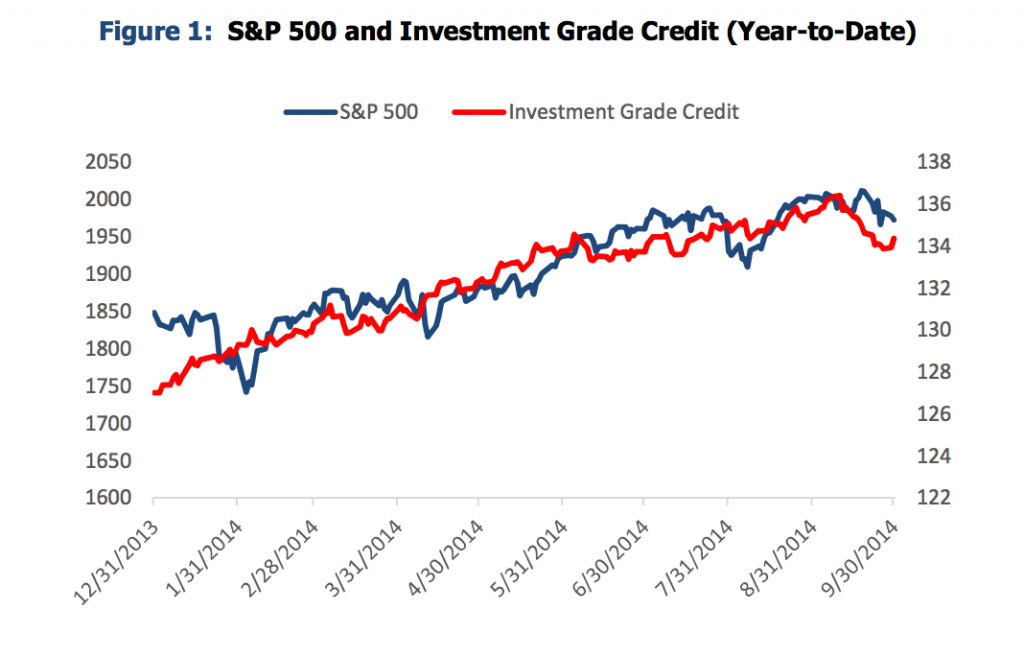

October 1, 2014

In this quarter’s commentary we will examine the Fed’s exit policy and its effect on markets as well as providing...

Read More

October 1, 2014

In this quarter’s commentary we will examine the Fed’s exit policy and its effect on markets as well as providing...

Read More

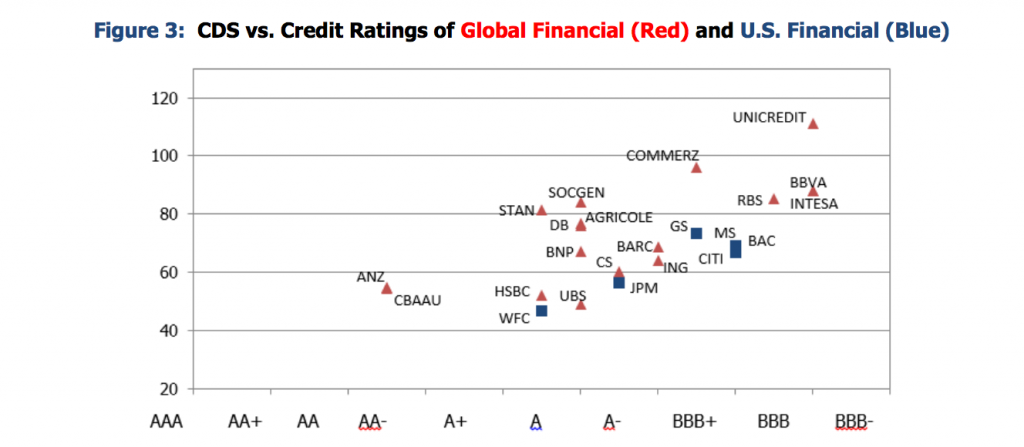

New Challenges

July 1, 2014

In this commentary, we’ll examine the current regulatory environment for money funds while providing an update on the state of...

Read More

July 1, 2014

In this commentary, we’ll examine the current regulatory environment for money funds while providing an update on the state of...

Read More

Rationalize Your Liquidity Premium

April 14, 2014

Many will read the title above and feel the way some do when talking with a mechanic about what might...

Read More

April 14, 2014

Many will read the title above and feel the way some do when talking with a mechanic about what might...

Read More

Changing of the Guard

April 1, 2014

In this commentary, we outline what is next for the Federal Reserve, discuss the upcoming earnings season, and briefly revisit...

Read More

April 1, 2014

In this commentary, we outline what is next for the Federal Reserve, discuss the upcoming earnings season, and briefly revisit...

Read More

The Year of the Taper

January 1, 2014

Meanwhile, central bank policy will continue to have a significant impact as the Fed carefully exits its high-octane policy.

Read More

January 1, 2014

Meanwhile, central bank policy will continue to have a significant impact as the Fed carefully exits its high-octane policy.

Read More

Brokers vs. Registered Investment Advisors

October 4, 2013

Why would someone choose to pay an explicit fee to a Registered Investment Advisor (RIA) when they could simply use...

Read More

October 4, 2013

Why would someone choose to pay an explicit fee to a Registered Investment Advisor (RIA) when they could simply use...

Read More

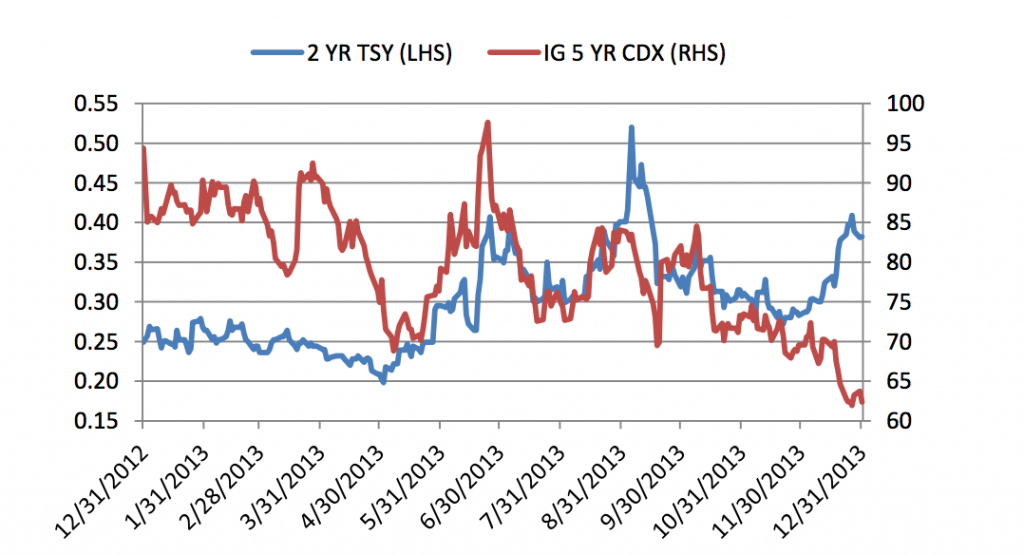

Taper, Taper, Toil and Trouble

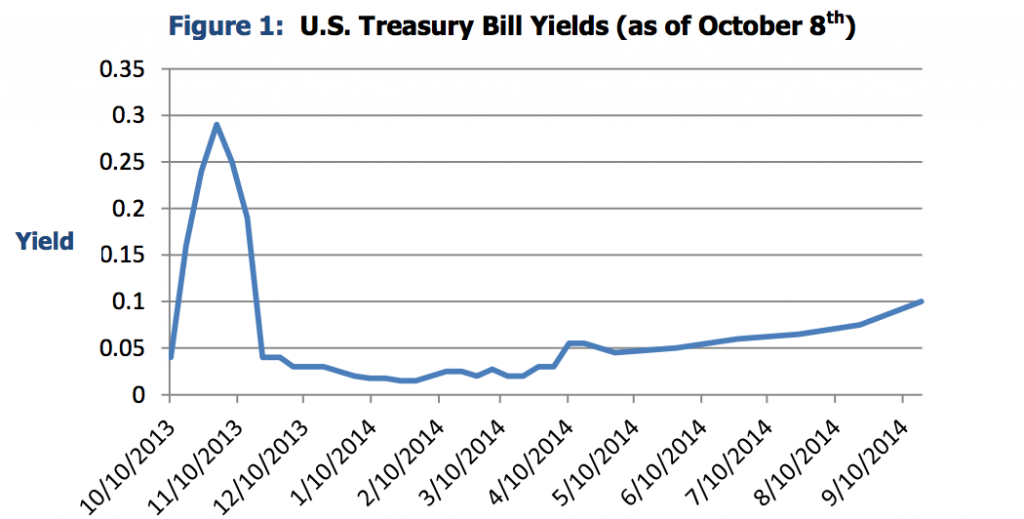

October 1, 2013

The odds of a technical default are rising, but it is still a very low probability event in our estimation.

Read More

October 1, 2013

The odds of a technical default are rising, but it is still a very low probability event in our estimation.

Read More

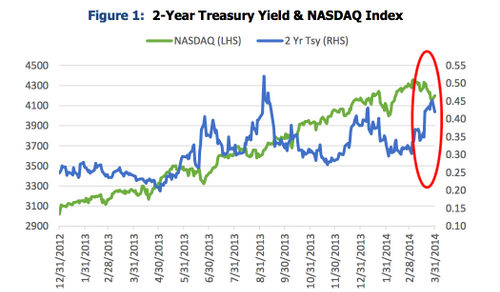

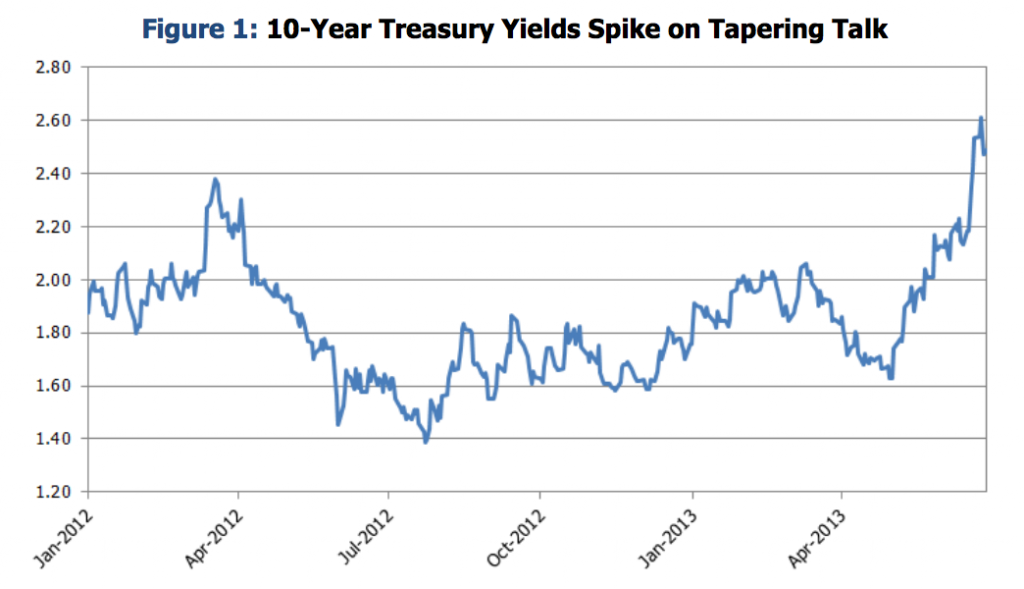

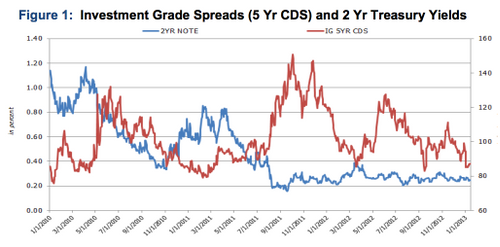

Talk Centers of Fed Tapering

July 1, 2013

While the market volatility post-announcement seemed a bit overdone in our view, investors should take notice: the FOMC’s recent statement...

Read More

July 1, 2013

While the market volatility post-announcement seemed a bit overdone in our view, investors should take notice: the FOMC’s recent statement...

Read More

The Specter of Higher Yields

May 1, 2013

In this month’s commentary, we will look at historical rising rate environments, consider portfolio implications and discuss what the future...

Read More

May 1, 2013

In this month’s commentary, we will look at historical rising rate environments, consider portfolio implications and discuss what the future...

Read More

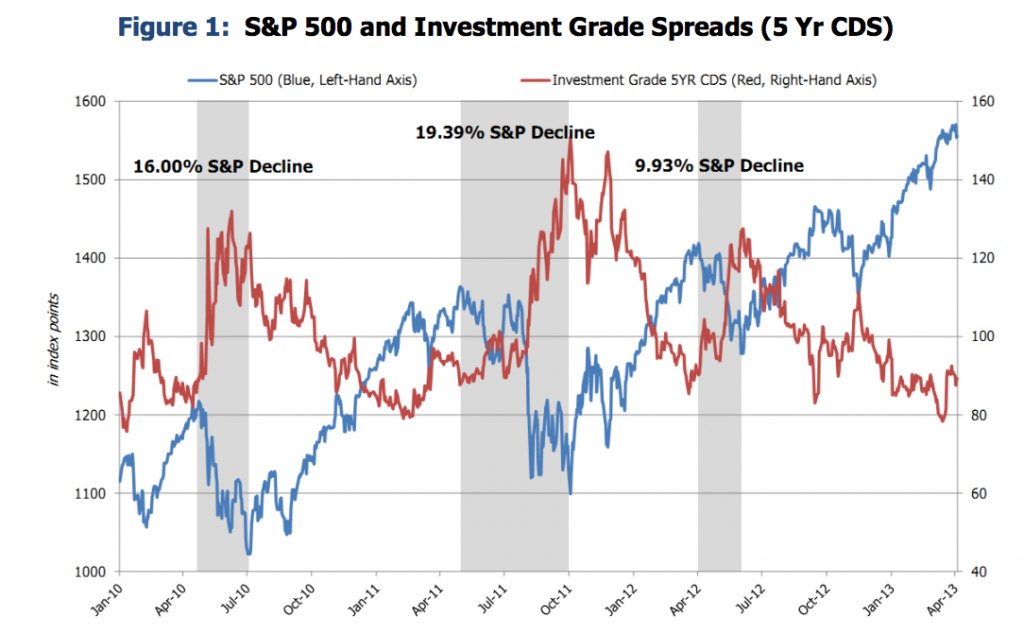

Volatility Awakens

April 1, 2013

If so, we would view wider credit spreads as an opportunity to selectively add risk rather than avoid it.

Read More

April 1, 2013

If so, we would view wider credit spreads as an opportunity to selectively add risk rather than avoid it.

Read More

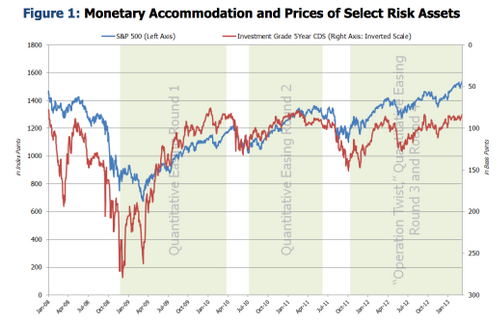

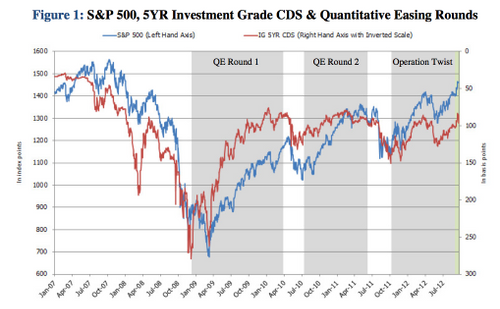

Quantitative Easing is a Market’s Best Friend

March 1, 2013

Like diamonds, QE incites joyous reactions from its respective benefactors and carries the perception, right or wrong, of lasting forever.

Read More

March 1, 2013

Like diamonds, QE incites joyous reactions from its respective benefactors and carries the perception, right or wrong, of lasting forever.

Read More

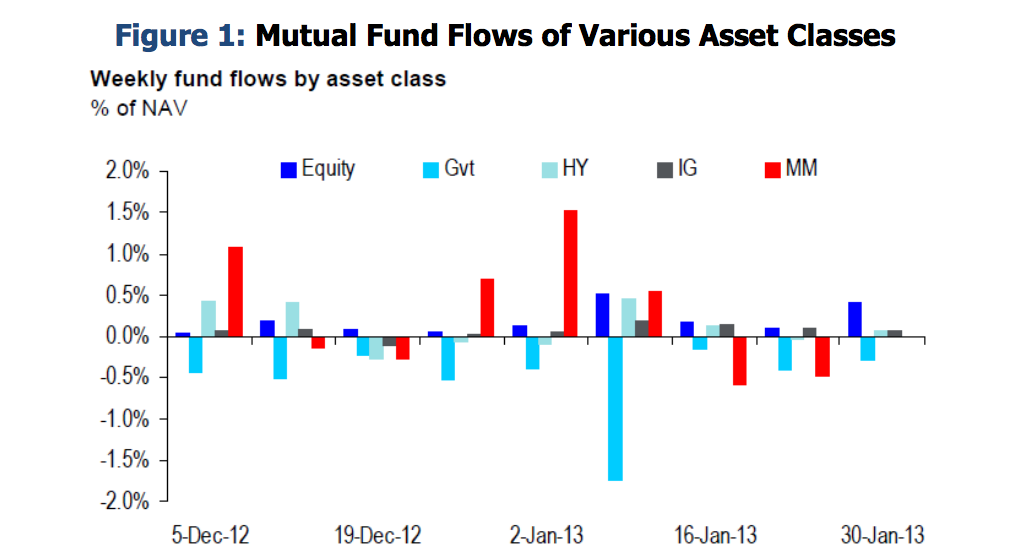

The Great Rotation

February 1, 2013

With the threat of rising longtern yields, analysts fear this may spell impending doom for the bond market; but should...

Read More

February 1, 2013

With the threat of rising longtern yields, analysts fear this may spell impending doom for the bond market; but should...

Read More

A Call to Action

January 1, 2013

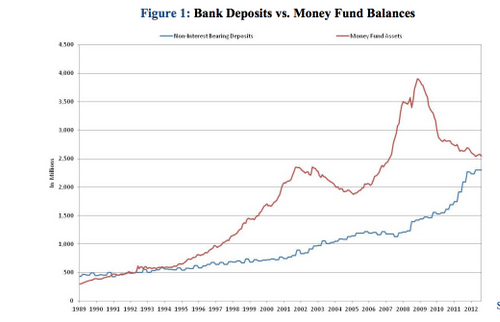

The dawn of a New Year coupled with the expiration of the muchutilized FDIC Transaction Account Guarantee (TAG) Program and...

Read More

January 1, 2013

The dawn of a New Year coupled with the expiration of the muchutilized FDIC Transaction Account Guarantee (TAG) Program and...

Read More

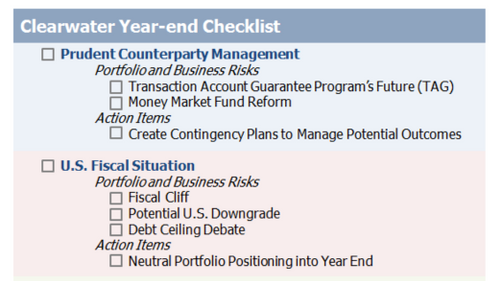

Making a List and Checking it Twice

December 1, 2012

Evaluating these list items now will provide professionals with the flexibility to design the best response for potential adverse outcomes....

Read More

December 1, 2012

Evaluating these list items now will provide professionals with the flexibility to design the best response for potential adverse outcomes....

Read More

Change You Can Believe In

November 1, 2012

Both events will add risk to assets that previously had little to none, and should motivate investors to seek prudent...

Read More

November 1, 2012

Both events will add risk to assets that previously had little to none, and should motivate investors to seek prudent...

Read More

The Convexity of Credit Revisted

October 1, 2012

While developed markets abroad have experienced exceptional volatility in 2012, this volatility has neither derailed the impressive performance of U.S....

Read More

October 1, 2012

While developed markets abroad have experienced exceptional volatility in 2012, this volatility has neither derailed the impressive performance of U.S....

Read More

The Summer of Our Discontent

September 1, 2012

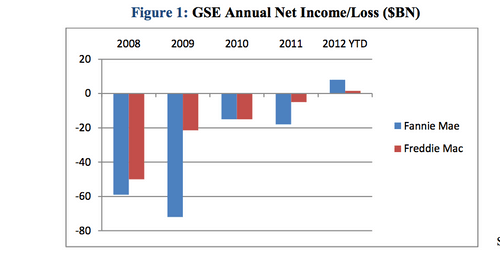

With that in mind we’ll discuss a couple of major developments in the short-maturity fixed income space: GSE support and...

Read More

September 1, 2012

With that in mind we’ll discuss a couple of major developments in the short-maturity fixed income space: GSE support and...

Read More

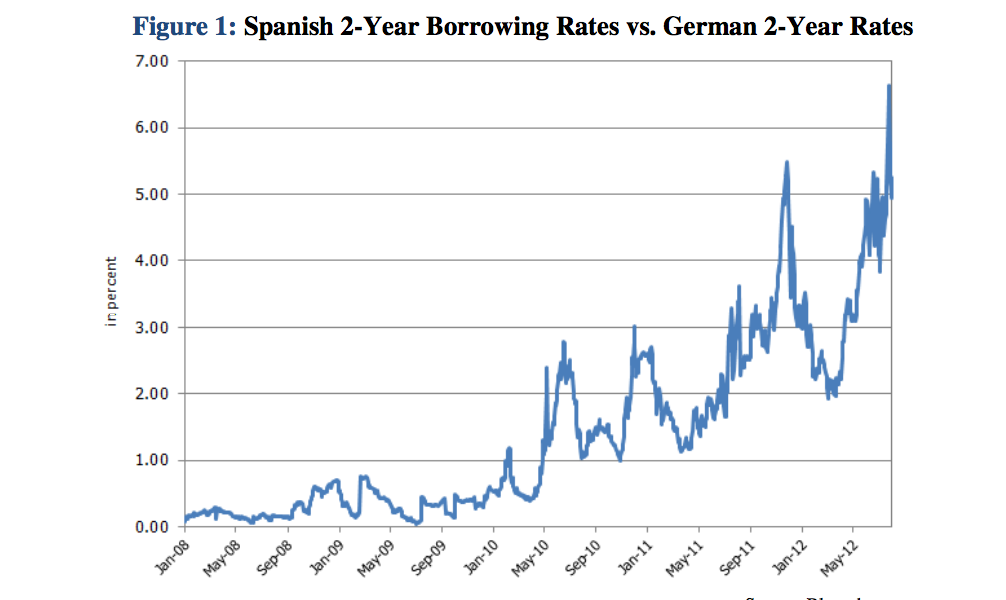

Waning Interest

August 1, 2012

By contrast, interest rates in “peripheral” countries remain volatile and on a general upward trajectory as eurozone policymakers struggle to...

Read More

August 1, 2012

By contrast, interest rates in “peripheral” countries remain volatile and on a general upward trajectory as eurozone policymakers struggle to...

Read More

United We Stand, Divided We Fall

July 1, 2012

While we will reserve judgment on the recent policy actions until additional details emerge, we anticipate further consolidation of monetary,...

Read More

July 1, 2012

While we will reserve judgment on the recent policy actions until additional details emerge, we anticipate further consolidation of monetary,...

Read More

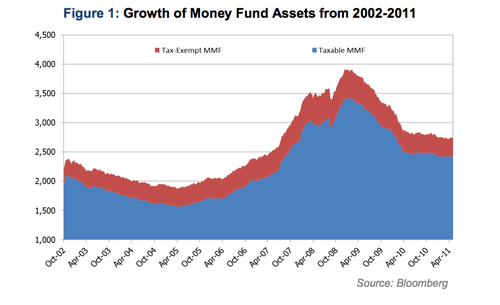

Money Market Reform

June 1, 2012

As such, corporate practitioners should begin to formulate a plan to respond to potential changes that could potentially affect their...

Read More

June 1, 2012

As such, corporate practitioners should begin to formulate a plan to respond to potential changes that could potentially affect their...

Read More

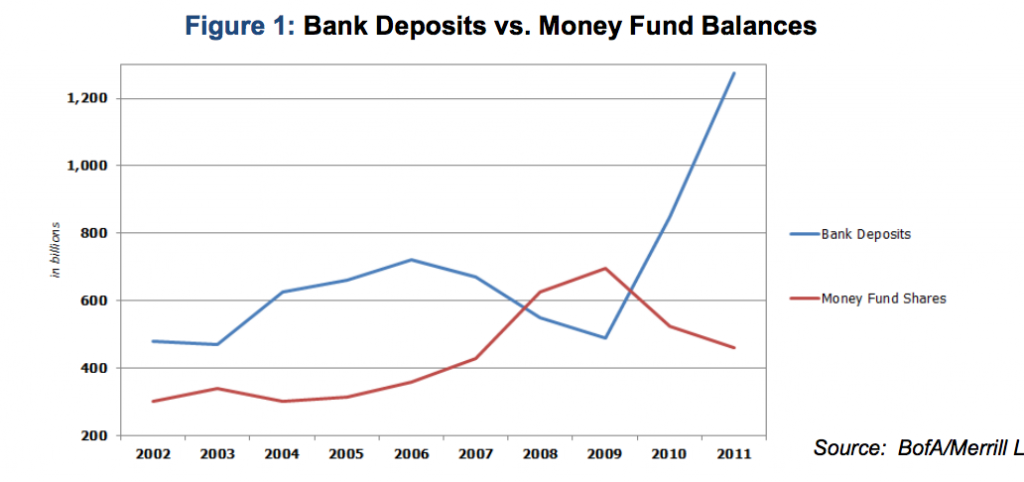

Money in the Bank

May 1, 2012

As the markets struggle to digest the European Union’s plight alongside renewed concerns about bank capital levels globally, investors should...

Read More

May 1, 2012

As the markets struggle to digest the European Union’s plight alongside renewed concerns about bank capital levels globally, investors should...

Read More

The Convexity of Credit

April 1, 2012

As in past periods of potential interest rate volatility, we recommend that investors remain duration neutral and opportunistic of sudden...

Read More

April 1, 2012

As in past periods of potential interest rate volatility, we recommend that investors remain duration neutral and opportunistic of sudden...

Read More

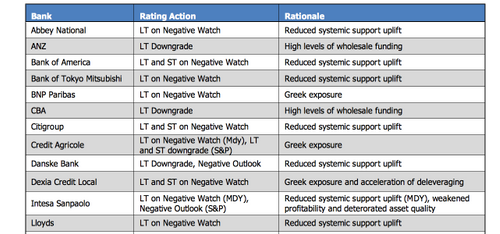

Credit Check

March 1, 2012

As these downgrades will most likely occur before summer arrives, we shall examine the potential unexpected credit exposure a cash...

Read More

March 1, 2012

As these downgrades will most likely occur before summer arrives, we shall examine the potential unexpected credit exposure a cash...

Read More

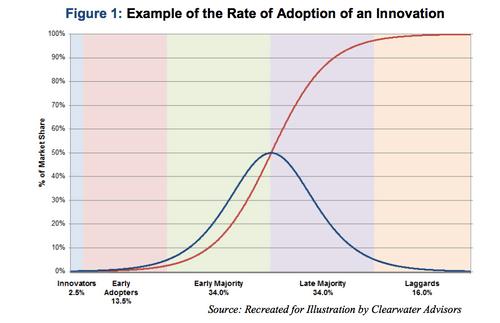

The Diffusion of Innovation

February 1, 2012

Further evaluation of the Diffusion of Innovation theory is relevant today in demonstrating how short-duration investors have adapted and, in...

Read More

February 1, 2012

Further evaluation of the Diffusion of Innovation theory is relevant today in demonstrating how short-duration investors have adapted and, in...

Read More

Happy “New Normal” Year

January 1, 2012

We continue to face a challenging investment environment as front-end supply diminishes, rates remain low, highly-rated credit remains suspect and...

Read More

January 1, 2012

We continue to face a challenging investment environment as front-end supply diminishes, rates remain low, highly-rated credit remains suspect and...

Read More

Money Market Blues

December 1, 2011

Money markets investors are operating in a dangerous environment full of overpriced, risky assets.

Read More

December 1, 2011

Money markets investors are operating in a dangerous environment full of overpriced, risky assets.

Read More

Jumping Over Dollars For Dimes

November 1, 2011

A defensive credit overweight will allow investors to navigate future volatility as the European debt crisis continues to unfold in...

Read More

November 1, 2011

A defensive credit overweight will allow investors to navigate future volatility as the European debt crisis continues to unfold in...

Read More

Pushing on a String

October 1, 2011

Consequently, as economic growth proves anemic, unemployment remains stubbornly high and inflation is contained within the Fed’s acceptable range, we...

Read More

October 1, 2011

Consequently, as economic growth proves anemic, unemployment remains stubbornly high and inflation is contained within the Fed’s acceptable range, we...

Read More

A Renewed Case for Extension

September 1, 2011

Our answer to this question, particularly, whether or not investors should extend the durations of their ultra-short liquidity pools, was...

Read More

September 1, 2011

Our answer to this question, particularly, whether or not investors should extend the durations of their ultra-short liquidity pools, was...

Read More

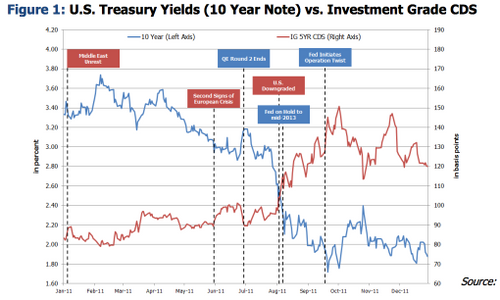

Deficits, Defaults, and Downgrades

August 1, 2011

The markets were volatile in the days surrounding the events of the S&P downgrades, additional support measures in Europe, and...

Read More

August 1, 2011

The markets were volatile in the days surrounding the events of the S&P downgrades, additional support measures in Europe, and...

Read More

Cruel Summer

July 1, 2011

Rather than fighting against summer headwinds by remaining invested in risky credits (i.e., prime money funds, bank deposits and direct...

Read More

July 1, 2011

Rather than fighting against summer headwinds by remaining invested in risky credits (i.e., prime money funds, bank deposits and direct...

Read More

House of Cards

June 1, 2011

Investors will most certainly discover that the risks and problems lurking deep in the shadows of their fund holdings are...

Read More

June 1, 2011

Investors will most certainly discover that the risks and problems lurking deep in the shadows of their fund holdings are...

Read More

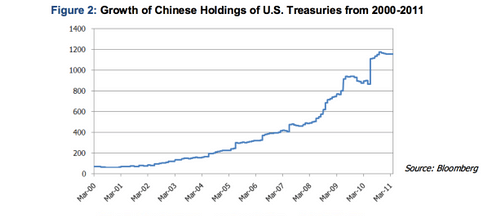

Where the Sidewalk Ends

May 1, 2011

As Congressional leaders begin the heated battle to reconcile long-term structural imbalances, both parties agree that the resolution of the...

Read More

May 1, 2011

As Congressional leaders begin the heated battle to reconcile long-term structural imbalances, both parties agree that the resolution of the...

Read More

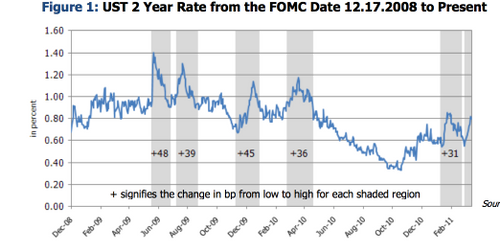

Is This Time Different?

April 1, 2011

We ask the question: Is this most recent rise in interest rates different than previous interest rate shocks we have...

Read More

April 1, 2011

We ask the question: Is this most recent rise in interest rates different than previous interest rate shocks we have...

Read More

Social Unrest

March 1, 2011

These factors will strengthen the FOMC’s stance of keeping interest rates low for an “extended period” despite inflationary headwinds as...

Read More

March 1, 2011

These factors will strengthen the FOMC’s stance of keeping interest rates low for an “extended period” despite inflationary headwinds as...

Read More

The Sorry State of the States

February 1, 2011

With taxpayers subjected to low income growth and elevated unemployment, state leaders have little option but to focus their deficit-reduction...

Read More

February 1, 2011

With taxpayers subjected to low income growth and elevated unemployment, state leaders have little option but to focus their deficit-reduction...

Read More

Review and Outlook

January 1, 2011

We therefore look to the labor market as an indicator of future FOMC actions and of the likelihood of sustainable...

Read More

January 1, 2011

We therefore look to the labor market as an indicator of future FOMC actions and of the likelihood of sustainable...

Read More

Fall of the Titans

December 1, 2010

We encourage investors to review banking relationships, bank deposits, direct security and prime money market holdings for exposure to troubled...

Read More

December 1, 2010

We encourage investors to review banking relationships, bank deposits, direct security and prime money market holdings for exposure to troubled...

Read More

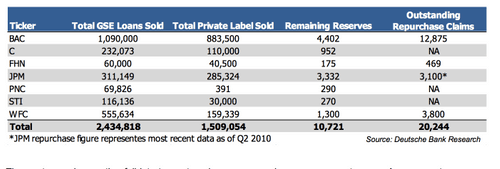

Mortgages Make Another Mess

November 1, 2010

A deeper dive into the mortgage market and the status of key players will help to clarify the issues.

Read More

November 1, 2010

A deeper dive into the mortgage market and the status of key players will help to clarify the issues.

Read More

Extend Now

October 1, 2010

Failing to adjust to the current reality in the money markets will lead to painfully low returns on investment portfolios...

Read More

October 1, 2010

Failing to adjust to the current reality in the money markets will lead to painfully low returns on investment portfolios...

Read More

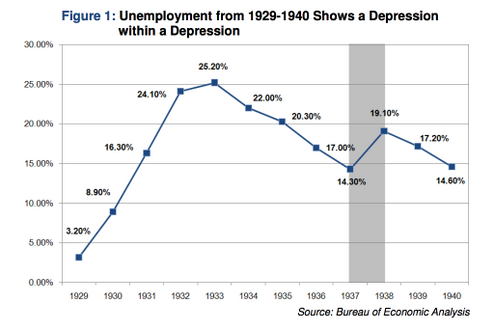

The Great Uncertainty

September 1, 2010

The largest hurdle to a sustained economic recovery appears to be the pervasive uncertainty that has entrenched market participants. Removing...

Read More

September 1, 2010

The largest hurdle to a sustained economic recovery appears to be the pervasive uncertainty that has entrenched market participants. Removing...

Read More

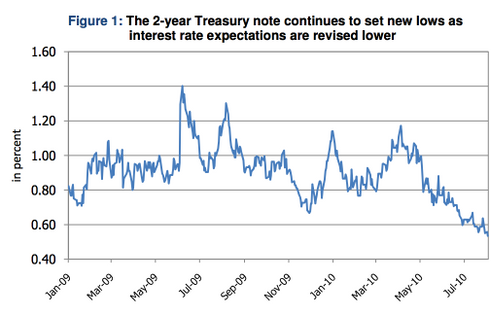

Unusually Uncertain

August 1, 2010

With short interest rates likely to remain range-bound at these low levels for the next 12-18 months, we recommend that...

Read More

August 1, 2010

With short interest rates likely to remain range-bound at these low levels for the next 12-18 months, we recommend that...

Read More

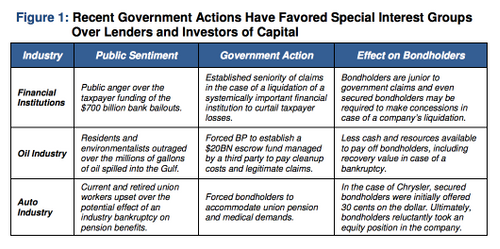

When More Means Less

July 1, 2010

This is a cause for concern, and investors should be wary of industries and companies in which the government and...

Read More

July 1, 2010

This is a cause for concern, and investors should be wary of industries and companies in which the government and...

Read More

Hell Hath No Fury Like SEC Scorned

May 1, 2010

We maintain an underweight view in the financial sector and see severe challenges to the industry going forward.

Read More

May 1, 2010

We maintain an underweight view in the financial sector and see severe challenges to the industry going forward.

Read More

The People United Will Leave the Banks Divided

April 1, 2010

In an extension of last month’s market commentary, we reemphasize the need for investors to monitor potential credit risks closely...

Read More

April 1, 2010

In an extension of last month’s market commentary, we reemphasize the need for investors to monitor potential credit risks closely...

Read More

Dr. Bernanke’s Dreaded Prescription

March 1, 2010

We do not anticipate the Fed raising rates until Q4 2010 at the earliest, and see high probability that action...

Read More

March 1, 2010

We do not anticipate the Fed raising rates until Q4 2010 at the earliest, and see high probability that action...

Read More

One of these Votes is Not Like the Others

February 1, 2010

The debate will intensify into 2010 over whether Governor Hoenig’s vote is a sign of changing sentiment at the Fed...

Read More

February 1, 2010

The debate will intensify into 2010 over whether Governor Hoenig’s vote is a sign of changing sentiment at the Fed...

Read More

Economic Remodel

January 1, 2010

We welcome the effects of intervention to stabilize the financial system, but we remain concerned about the lingering effects of...

Read More

January 1, 2010

We welcome the effects of intervention to stabilize the financial system, but we remain concerned about the lingering effects of...

Read More

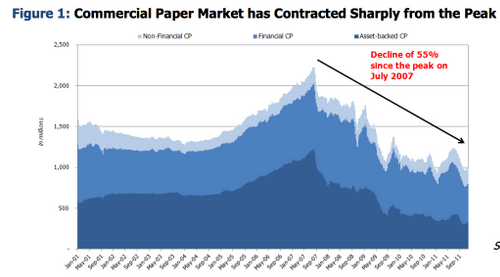

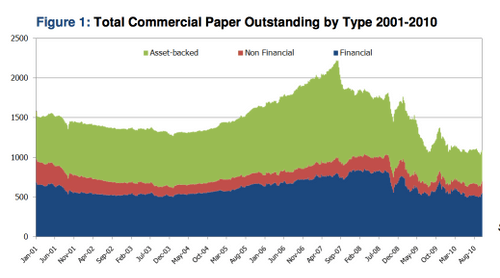

How Money Markets Fail

September 26, 2008

As the credit crunch rippled into nearly every instrument in the debt market, investors wondered how purportedly “safe” securities (so...

Read More

September 26, 2008

As the credit crunch rippled into nearly every instrument in the debt market, investors wondered how purportedly “safe” securities (so...

Read More

Investment Accounting Consideration

June 6, 2008

In February 2005, PriceWaterhouseCoopers announced that they would no longer qualify auction rate securities as cash equivalents on the balance...

Read More

June 6, 2008

In February 2005, PriceWaterhouseCoopers announced that they would no longer qualify auction rate securities as cash equivalents on the balance...

Read More

Centralized Trust and Customer Relationships

June 6, 2008

Few people do without automobile insurance even though annual policy premiums can easily run into the thousands of dollars....

Read More

June 6, 2008

Few people do without automobile insurance even though annual policy premiums can easily run into the thousands of dollars....

Read More

Securities Lending

June 6, 2008

In today’s capital markets, investors with large portfolios always seek opportunities to maximize liquidity and return while preserving principal value...

Read More

June 6, 2008

In today’s capital markets, investors with large portfolios always seek opportunities to maximize liquidity and return while preserving principal value...

Read More

Internal Investment Manager or External – Or Both

June 6, 2008

Organizations frequently explore the question of how to maximize the return on their investment portfolio by debating the benefits or...

Read More

June 6, 2008

Organizations frequently explore the question of how to maximize the return on their investment portfolio by debating the benefits or...

Read More